stash tax documents turbotax

You should consult with a tax or legal professional to address your particular situation. Each year Stash will send you a tax statement so that you can file your taxes appropriately.

Turbotax Makes Filing Almost Fun Inside Design Blog Free Tax Filing Filing Taxes Turbotax

The forms youll be receiving represent your account activity from the previous calendar year or any activity completed to qualify for that years contributions.

. Highlight the areas that apply to you and make sure you have that information available. And heres a bonusTurboTax offers Stashers up to 20 off federal tax prep. Stash will make your relevant tax documents available online in mid February.

I just wanted to see what the app was. Documents include earnings statements banking interest statements and documents indicating investment profits. In this guide we break down the basics of cryptocurrency taxes and walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTaxboth.

However Stash Invest accounts are taxable brokerage accounts and you are required by the IRS to report income earned from capital gains and other applicable distributions. Last year I transferred my whole account from Stash over to a real brokerage and as a result because of the fractional shares most if not all of my equities were liquidated. Acorns does not provide tax or legal advice.

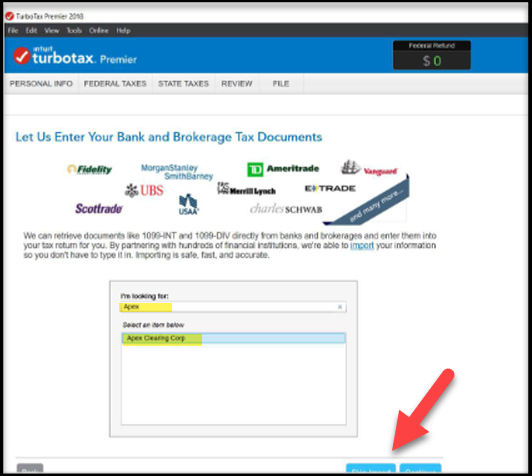

Youll find your tax forms separated out by account. As a result I should have a 1099B for the sales of these equities from Stash but when I try to. On the next screen type Apex into.

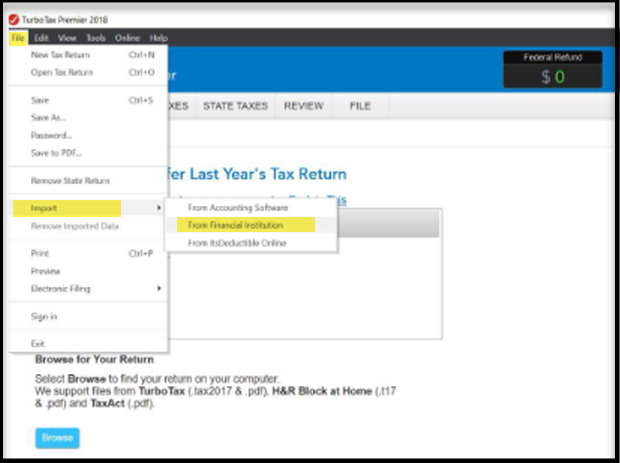

After starting a new return from the File menu please select Import then choose From Financial Institution. Now youve got the documentation you need to declare any income or loss you may have realized in your Stash. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Americas 1 tax preparation provider. Join The Millions Who File With TurboTax.

Better yet attach the list to a folder of your tax documents and check items off as you add them to the folder. Is a digital financial services company offering financial products for US. 1 best-selling tax software.

Based on aggregated sales data for all tax year 2020 TurboTax products. Select Stash from the search results. On the next screen enter Apex into the field titled Im looking for and then select Apex Clearing Corporation.

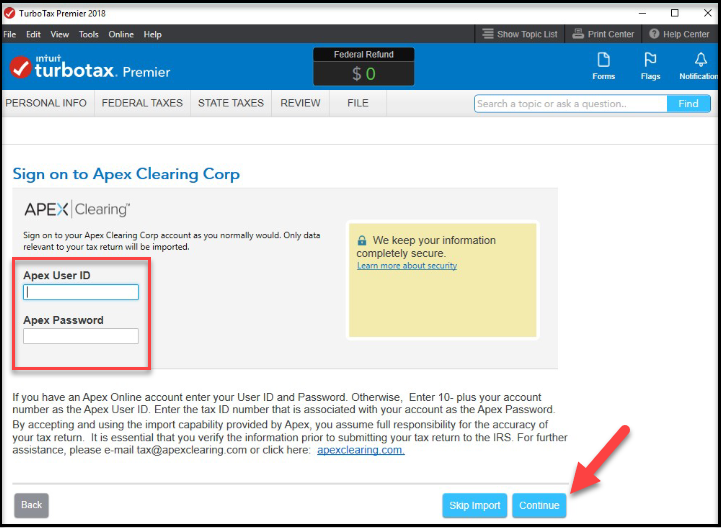

TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app. Get started with TurboTax IntuitTurboTax is a paid partner of Stash. 8CE12345 in the first field and your social security number in the second field.

Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. Using those credentials TurboTax will list your 1099 form from Stash. You may be eligible to receive a 1099 form if your investment activity with Acorns last year meets IRS report.

But turns out I had a tax form 1099-B which doesnt say anywhere if I owe taxes or not. Stash is not a bank or depository institution licensed in any jurisdiction. To import your Stash Capital tax forms enter your Apex account number eg.

This should not be construed as Tax advice. No you only enter investments when you sell them. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Type Stash into the search bar. Use your 8-digit account number and the Social Security Number associated with the account to enable direct document import. The 1099-DIV is a common form which is a record that Stash not your employer gave or.

When you are completing your tax return and it is time to enter 1099 information you can use the TurboTax import feature. Next the client will be asked to login. Americas 1 tax preparation provider.

You can access historical documents year round Tax Documents section of Account Management. Review the tax documents provided by Stash. Tax documents are available in the Titan app via Account tab Documents Tax Account Statements as well as on Titans investor website Go to Documents Statements.

1099-DIV 1099-B etc at the top of pg. From the TurboTax import screen follow these instructions. A 1099-DIV tax form is for getting paid on dividends.

Tax Preparation Checklist Before you begin to prepare your income tax return go through the following checklist. You CAN import all your tax information into TurboTax from Stash. Here is how you can import your tax document to your TurboTax.

Select your Profile Icon in the top right corner. Is there anyone that can help me. I used stash invest for a little while and mainly had a loss of couple dollars.

1 online tax filing solution for self-employed. Click here to see how to locate your Stash account numbers. See How Easy It Can Be Today.

Select your Profile Icon in the top left corner Scroll down and select Account Settings Scroll down to the Documents section Tap Tax Documents to access your 1099 forms Tap Crypto Statements to access your Annual Crypto Statement Via Public for Web on your desktop browser. Once youve logged in you can also click on your name in the top right corner of the screen select Statements Tax Documents and then Tax Documents. When prompted with Did you sell any investments in 2021 and Did you get a 1099-B or a brokerage statement for these sales click the Yes button.

When items arrive stash them in your tax folder so youll have all necessary paperwork at the ready. To enable this functionality the TurboTax team has partnered with CryptoTraderTax. Now you can automatically upload your Stash tax documents with TurboTax.

Copy or screenshot your account number and type of tax document is. After starting a New Tax Return from the File menu select Import then From Financial Institution 2. Please consult a Tax professional for questions regarding your personal circumstance.

In the Public App. Based on aggregated sales data for all tax year 2020 TurboTax products. If you earned more than 10 in dividends from your Stash investments youll receive a 1099-DIV.

1 best-selling tax software. The above link should take you to your documents. I shut the account and everything.

1 online tax filing solution for self-employed. 1099-B Portable Document Format PDF For tax year 2021 you may download your Stash Capital Form 1099-B PDF file and submit it. Navigate to the section labeled Investment Income and select the entry for Stocks Mutual Funds Bonds Other.

Used Stash invest now have a 1099-B. In general if you hold your investments. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents.

Ad TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. As tax season draws near tax scammers target unsuspecting individuals. Based upon IRS Sole Proprietor data as of 2020 tax year.

The document is titled 1099 Tax Document. Transferred brokerage accounts no 1099B Stash SUCKS.

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Tax Refund Turbotax Tax Free

R Snap Tap Done Get Your Taxes Done Right Anytime Anywhere 0 Fed 0 State 0 To File Absolute Zero Fed Free Ed The Turbo Turbotax App Tax Refund

Turbotax Direct Import Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Official Stash Support

How Do I File My Taxes Using Turbotax Online Turbotax Support Video Youtube

Can I Import My Sofi Invest Tax Documents Into Turbotax Sofi

Import Your Investment Results Into Turbotax Youtube

How To Read Your Brokerage 1099 Tax Form Youtube

Can I Import My Sofi Invest Tax Documents Into Turbotax Sofi

Invest Save And Learn With The Stash Investment App Investment App Investing Apps Investing

Invest Save And Learn With The Stash Investment App Investment App Investing Apps Investing

Turbotax Direct Import Official Stash Support

Can I Import My Sofi Invest Tax Documents Into Turbotax Sofi

Turbotax Debit Card Covid 19 Stimulus Facebook

Turbotax Direct Import Official Stash Support

Turbotax Review 2022 The Best Tax Return Service Today

How Do I File My Taxes Using Turbotax Online Turbotax Support Video Youtube

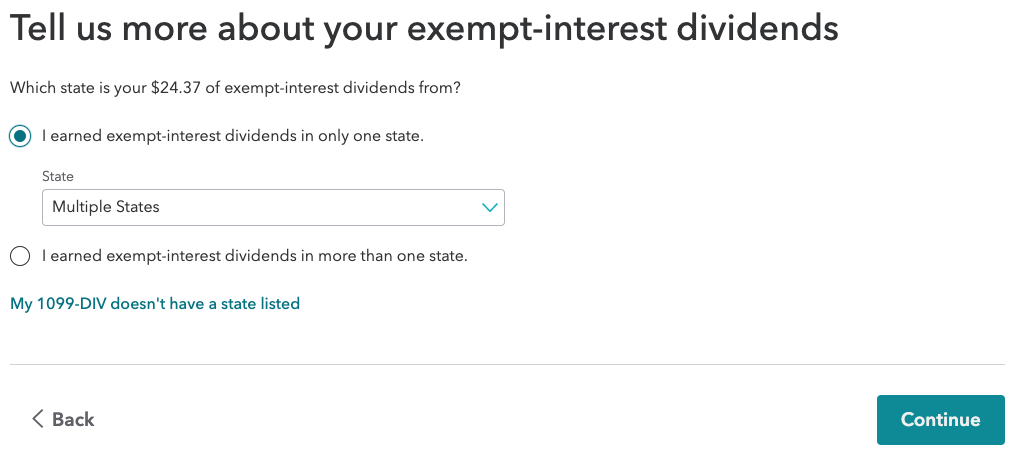

How Do I Address Exempt Interest Dividends In My Tax Return Or Tax Software Wealthfront Support